One of the most important tasks of running your business is managing the payroll. While there are plenty of solutions to choose from, it can be a hard decision to make when there are many alternatives. In most SaaS companies, the competitive edge lies in their unique features, plans, and most importantly, pricing. With that being said, let’s take a look at one of the top payroll services, SurePayroll, and see if it’s the right fit for your company.

Overview

SurePayroll offers payroll, human resources, and employee benefit solutions. Further recognition of the company’s success is that it was named the Best Payroll Service for Household Employers in 2021 by Business News Daily.

Who is SurePayroll for?

So, what makes SurePayroll stand out? SurePayroll is SPECIFICALLY designed for small business owners. Their services and add-on plans are tailored to meet the needs of small business owners, nannies & households, benefits & HR, and finally accountants. Let’s learn more about their features, benefits, plans, pricing, and pros/cons.

Features

Not all payroll companies provide all the necessary services and features you’re looking for. However, you’ll find that SurePayroll offers a wide variety of features that just might fit the needs of your company. Check out some of the top features below.

Automation

Managing payroll is a daunting task, even for a small to medium-sized business. That doesn’t have to be the case with SurePayroll. SurePayroll offers a simple and fairly straightforward setup. Enter your employees’ salaries and wages, and leave the rest to SurePayroll’s automated service. SurePayroll’s automated systems collect, organize, and store your employees’ time and attendance information, as well as tax and benefits deductions, and perform the calculations for you.

All that’s left for you to do is submit manual inputs of PTO hours, and that’s it. In addition, SurePayroll will send you reminders to do the manual input, making it as easy as possible. When payroll day comes around, you can rest easy knowing the automatic system takes control without you having to do a thing. This results in a streamlined payroll process with timely and accurate employee pay.

Payroll Taxes

Not comfortable calculating and filing payroll tax forms? This is the feature for you. Many small businesses feel the same way about payroll taxes, and SurePayroll takes care of it for you by filing taxes on your behalf. In addition, they provide guides and advice concerning taxes, as well as W-2 tax form support, and more.

In-depth Reporting

SurePayroll has a comprehensive reporting system that generates and distributes reports. Every aspect of an employee’s identity is reported, from their name and social security number to their address. As a result, businesses save valuable time during onboarding.

Other payroll reports include:

- New Hire Reports

- Check Register

- Deduction Reports

It is important to note that customization on these reports is limited. However, if you’re needing more customization SurePayroll allows you to export their reports to Microsoft Excel.

Streamlined Integration

For most small to medium-sized businesses, implementing payroll integration is essential. Furthermore, most companies use various tools to complete their tasks, and the same goes for payroll. With SurePayroll’s third-party integration feature, you can streamline the entire payroll process. Complete other tasks like time and attendance, accounting duties, and more HR-related activities with streamlined integration.

For example, here are some of the integrations SurePayroll highlights on their website:

Accounting Services:

- QuickBooks

- Kashoo

- Xero

- Sage

Time & Attendance:

- SpringAhead

- Homebase

- Inception

Accounting Software:

- AccountEdge

- QuickBooks Online

- Sage 50

- Xero

Other Features:

- Mobile App

- Direct Deposit

- Unlimited Pay Runs

- Online Pay Stubs

- Employee Self Serve

- Same-Day Payroll

- Compensation Management

- Employee Management

- Employee Portal

- Multi-State

- Sick Leave Tracking

- And More

Competitor Comparison

Source: GetApp

3 Ways SurePayroll Differs from the Competition

Accredited

When choosing a provider, you want to make sure you’re going with a reputable company. Surepayroll has been in business for more than 20 years and was named 2021’s best payroll service for household employers by Business News Daily.

SurePayroll Ratings:

- GetApp: 4.2

- PCMag: 4.0

- Capterra: 4.2

- Software Advice: 4.19

Small Business Oriented

When you visit the SurePayroll website, the first thing you’ll read is “Small Business is Our Business.” SurePayroll is small business oriented and doesn’t hide it. Furthermore, it is a great payroll software provider for small businesses that operate in multiple states and need essential features that don’t break the bank.

Types of Small Businesses that can benefit from SurePayroll:

- Restaurants

- Sole Proprietors

- Nannies

- Accountants

- And more.

Budget-Friendly

When comparing SurePayroll to other notable payroll software providers it becomes clear that SurePayroll offers the best bang for your buck. It offers key features and integration at an affordable range for small businesses. How affordable? Read on.

Pricing & Plans

Many SurePayroll alternatives offer similar services, but few offer such low fees.

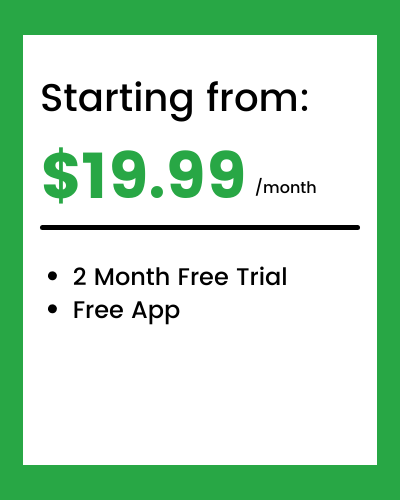

SurePayroll’s pricing starts at $19.99 per feature, per month with their Self Service Plan. However, the Self Service plan charges an additional $4 per employee and requires that you handle tax filings for your business. For $29.00 per month, you can get their Full-Service plan. The Full-Service plan charges an additional $5 per employee, but SurePayroll WILL handle payroll taxes for you.

Above all, both plans include features like automatic payroll, direct deposit, advanced reporting, third-party integration, and more. In addition to their plans, you can add-on solutions to create a customized plan perfect for your small business.

Although there isn’t a free version of SurePayroll, they do offer a 2-month free trial which you can take advantage of to see if it’s the right fit for you.

Plan Comparison

Pros and Cons

| Pros | Cons |

| Affordable | Tax filing in Ohio/Pennsylvania and multistate filing require a monthly fee |

| Access to Mobile App | Limited Reports |

| Employee Portal | Additional fees for year-end forms |

Is SurePayroll Right For You?

In conclusion, if you’re looking for an affordable trustworthy payroll service that has been around for many years, SurePayroll could be right for you.

Looking for a payroll service provider for your company?

At 360Connect, we understand payroll is one of the most important aspects of running your business. That’s why we connect you with up to 5 FREE price quotes from pre-qualified payroll service providers.