The last thing you want to do when running payroll makes a mistake that doesn’t allow your employees to be paid. This can lead to serious consequences for the morale of your staff and your company. Instead of risking that scenario, why not automate your payroll process? With ePayroll, you can do this and more with the tools and automation provided by the software.

Don’t believe us? Don’t worry we’ve got the facts to back it up!

ePayroll Definition

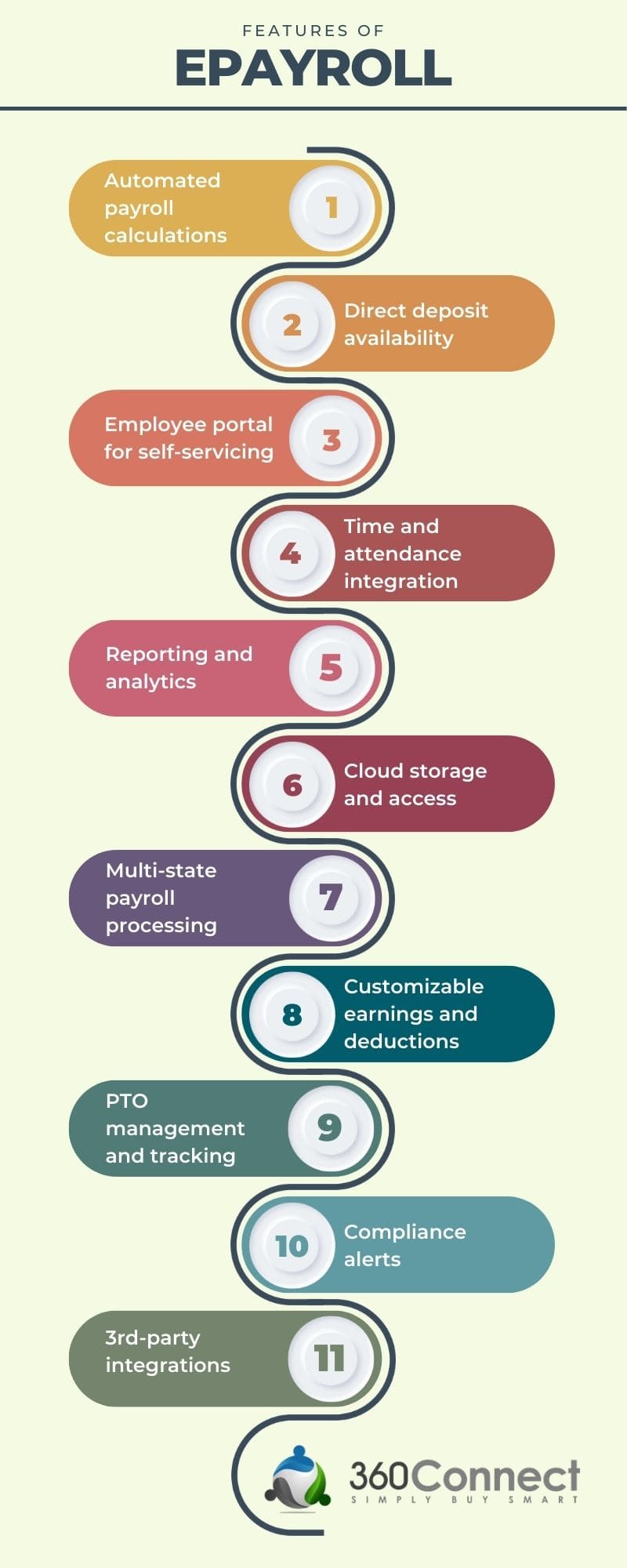

- Employee portal to view and manage documents/pay

- Reporting & analytics

- PTO management

- Cloud storage

- Automated calculations

- And more!

Advantages of ePayroll

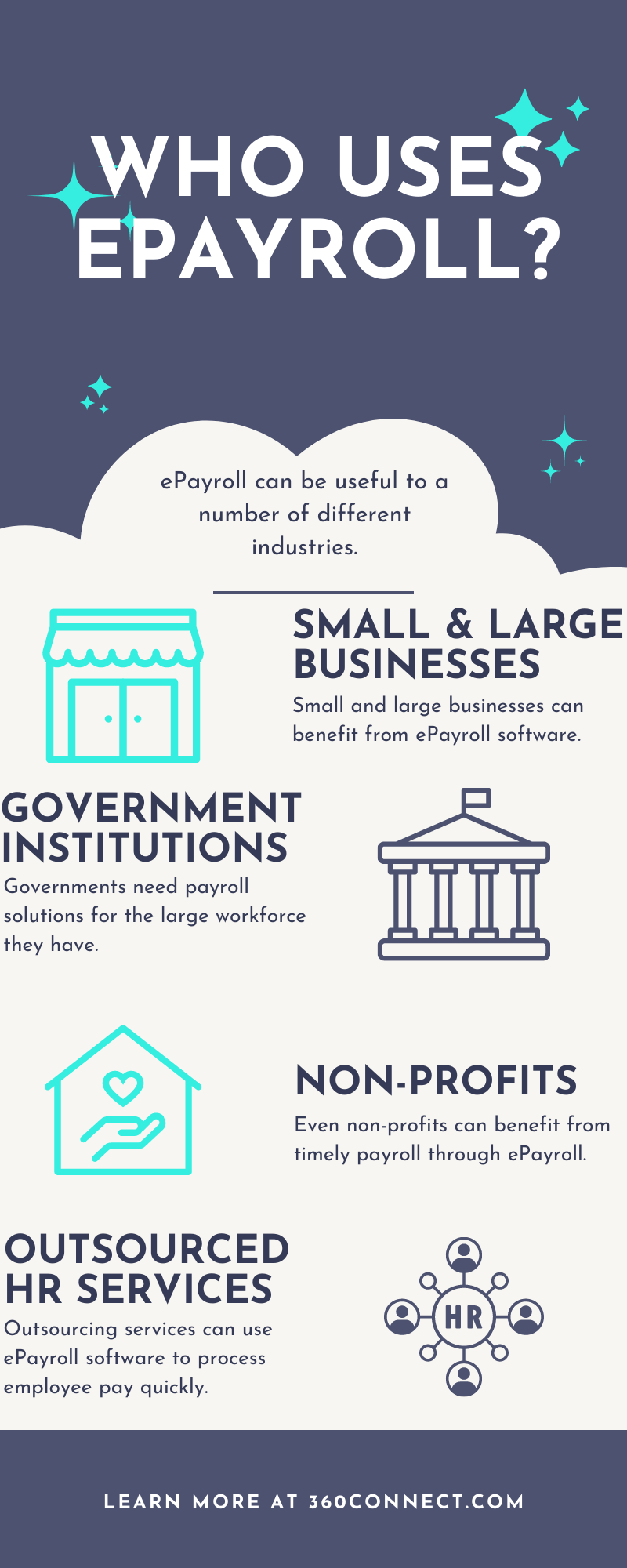

ePayroll offers both large and small businesses advantages when it comes to running payroll and automating your services. Even with a small business, you can ensure that your employees receive the best payroll process for their needs.

Accuracy

ePayroll provides better accuracy in payroll processing by automating calculations, integrating with time and attendance systems, and ensuring compliance with regulations. These benefits reduce the risk of errors and save time and money for companies. More importantly, the software can automatically flag workers when time is outside of normal parameters.

Time Savings

ePayroll leads to time savings for businesses by automating payroll processes, integrating with time and attendance systems, providing real-time updates, and streamlining reporting. This eliminates the need for manual data entry, reduces the time required to process payroll, and ensures that payroll is accurate and up-to-date. You will still need someone to review these records before running payroll, but all of that raw data is automatically logged for you. No need to input multiple streams of data.

Cost Savings

ePayroll leads to cost savings for businesses by reducing manual labor costs, printing and mailing costs, and the risk of errors and fines. ePayroll software can eliminate wasted time and unnecessary man-hours. Instead of hiring multiple people to handle one job, you can simplify the job to be completed by as few people as possible.

Increased Security

Instead of having paper files that can be accessed without the proper security measures, invest in ePayroll. Most ePayroll software uses the latest cybersecurity measures to keep your employee data safe. Employees can also securely view their documents without needing a physical copy and they can access those documents at any time.

Accessibility & Convenience

ePayroll provides accessibility and convenience for businesses by offering online access to payroll information from anywhere, self-service portals for employees, multiple payment methods, and integration with other systems. This streamlines payroll management and reduces the need for manual handling of employee requests. View and edit your payroll data on your phone, tablet, or computer as long as you have an internet connection. Even if a mistake does occur, you can fix it with just a couple of clicks!

ePayroll Implementation

ePayroll may seem like a complicated process, but it doesn’t have to be with the right plan. In fact, with some forward-thinking, you can make the switch to ePayroll easy and efficient.

Steps to take for implementation

1. Do you research

Before choosing any provider, you need to get a better understanding of the market. Look up top providers and see the features that align with your needs. You can start your search here if you’d like:

The 6 Best Payroll Software for Small Businesses

Learn MoreKnowing your budget is critical for finding the right supplier for you. Know what you can spend monthly or yearly on a service. Make sure to plan for scaling your business and the cost of adding new users or employees to the ePayroll service.

2. Set an implementation date

Once you have identified a supplier you want to work with, it’s best to set a date to implement this new program. This will give you time to practice the new program and create new procedures. Doing this can help make the transition easier and get you started faster. A lack of planning can be one of the biggest problems when it comes to switching to a new system.

3. Train, train, train

The success of any transition is dependent on how prepared you are. Appoint someone in your company (preferably an HR specialist) to tackle this. They can learn the system and then help teach your other team members. This can also give your team members time to ask questions and receive vendor help before going live!

Challenges of Implementation

Some of the most common challenges of implementing a new ePayroll service is:

- Data migration: Transferring employee data from the old payroll system to the new system is a crucial step in implementing an ePayroll service. This process requires meticulous attention to detail and a thorough understanding of the data being migrated.

- Vendor selection: Choosing the right ePayroll vendor is critical to the success of the project. Finding the vendor to help you implement your new ePayroll system is key to making the implementation stick.

- User adoption: Your company can’t make the best use of the new ePayroll software if they don’t know how to use it early on. Helping employees adjust to the new system quickly is key to realizing the benefits of the new system early on.

- Integration: Integrating ePayroll service with existing systems can be a challenge, particularly if the organization has several legacy systems in place. If an ePayroll solution doesn’t integrate with the tools you need, you may need to find alternative tools or use another ePayroll provider.

- Compliance: The payroll function involves complying with a variety of laws, regulations, and policies. In addition to federal, state, and local tax laws, employers must also comply with labor laws, healthcare regulations, and retirement plan rules. Your new ePayroll system should adhere to these laws from day one.

- Security: Using an ePayroll service requires ensuring the security of sensitive employee data, like Social Security numbers, bank account numbers, and addresses. In order to prevent unauthorized access, breaches, or hacks, adequate measures must be taken.

Ready to Use ePayroll?

ePayroll systems improve the way companies handle their payroll processes. The use of ePayroll systems eliminates the need for manual processing and reduces the potential for errors. Most systems are secure, and efficient, and offer a range of benefits to both employers and employees.

If you’re a business owner or manager, it’s time to consider implementing an ePayroll system. You’ll save time and money, reduce the potential for errors, and improve employee satisfaction. 360Connect can help you find the right ePayroll provider for your needs! Just fill out our 1-2 minute form and we’ll contact you to verify your information and needs. From there, you can sit back and relax and receive up to five quotes all for free! It’s that easy!