One of the most common problems faced by small business owners is payroll. From navigating payroll processing and managing employee tax withholding, small business owners may feel left in the dark about how to properly run their payroll. In turn, small businesses can make some costly mistakes. If you are struggling with your payroll, don’t worry. There is software that can help you automate your payroll and turn it into a source of strength. Here are the 6 best payroll software for small businesses.

Sources: American Productivity & Quality Center, National Employment Law Project, QuickBooks Blog, National Payroll Week, Kronos Workforce, Workforce Institute

Have the same troubles with your payroll? Then you need a new payroll service or software.

Paychex:

Great for: saving time and scaling your business.

Paychex is recommended as one of the top payroll software you will find in the market. They have specific solutions aimed at small, medium, and large-sized businesses. Paychex offers an all-in-one system to handle your HR needs, payroll, and benefits. You can automate tax payments and automate part of your payroll duties as well. Everything is logged digitally, no more filing cabinets stuffed full of endless logs.

Software Benefits and Features:

- Calculates, files, and submits payroll taxes.

- HR & payroll integration.

- Time tracking capabilities with a mobile application. Can integrate hours right into payroll.

- 401k record keeping.

- Health insurance integration within the software.

- 24/7 Support.

- Multiple ways to pay employees include direct deposit, pay card, paper checks, and Pay-on-demand.

- W2 and 1099 Forms.

- Desktop and mobile application for on-the-go tracking.

- Payroll alerts for mistakes or problems.

- Detailed analytical reports.

- Recognized as a top HR by 8 different industry experts

Price:

| Plan | Price | Sample Services included |

| Paychex Flex® Essentials | $39/mo. + $5 per employee | – Direct deposit and onsite checking – Employer and employee mobile application – Standard analytics and reporting – General ledger report |

| Paychex Flex® Select | Custom Quote | – Everything in essentials – Dedicated payroll specialist – Paychex learning management system – Additional employees pay options |

| Paychex Flex® Pro | Custom Quote | – Everything in select – Accounting software integration – State unemployment insurance – Employee screening tools |

ADP:

Great for: Those looking for an established brand and those who employees that are outside the U.S.

ADP is one of the largest and most well-known payroll and HR software providers in the United States, however, they are known throughout the world. They will help you automate most tasks of your payroll system and offer multiple tiers of service for small and large companies alike. You’ll be able to automate processes like calculations, tax withholdings, paper checks, and digital payments with ease. ADP is a well-established brand with over 70 years in the business. They work with some of top brands in the world such as Virginia Wesleyan University, Bethel International United Methodist Church, and Jelly Belly to name a few. ADP isn’t the cheapest option, but they are an award-winning company with an established record of excellence.

Benefits and features:

- Automated online payroll. Everything is stored in the cloud.

- Payroll taxes are calculated and paid for you.

- Time tracking and HR integration.

- Employee and administrative apps.

- Flexible payment options.

- Scalable services and outsourcing are available.

- Automatic W-2 and 1099 form creation and sent to an employee.

- Automated quarterly and annual reporting.

- Tax error flagging.

Price:

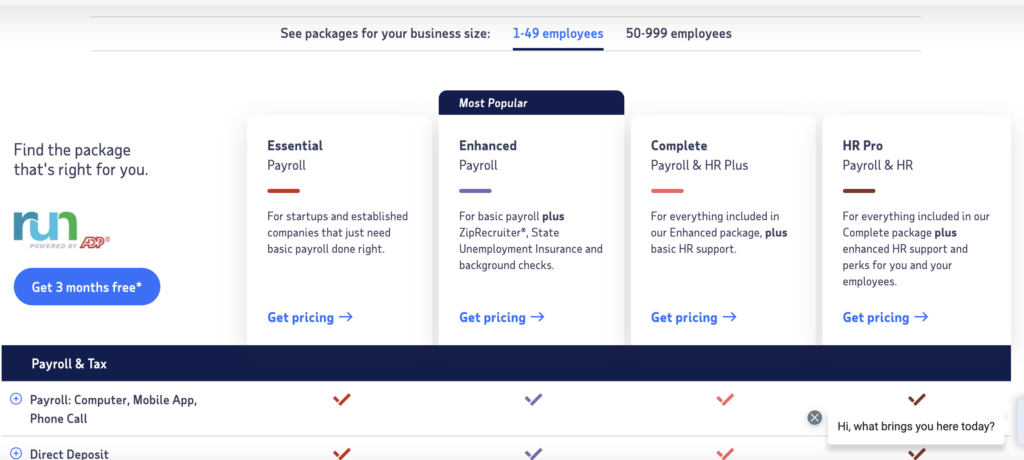

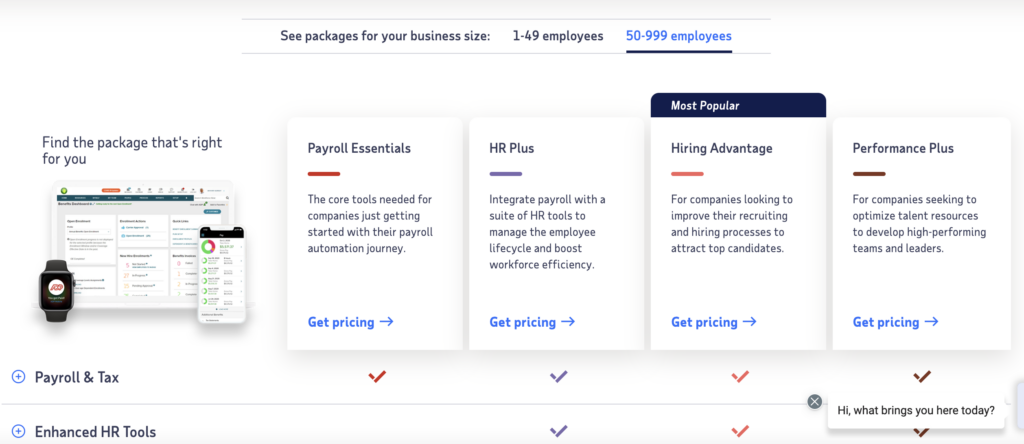

ADP splits its services into two categories based on employee size. From there, they offer multiple tiers of payroll services.

1-49 Employees:

Source: ADP Packages

50-99 Employees

Each plan offers and requires a custom quote. Why? Because there are many add-ons you can mix and match with depending upon your needs. For instance, you could just need the “essentials” package for your small business. You could also add “Health Insurance” as an integration instead of paying for a larger package.

Additional Reading: In-House vs. Outsourced Payroll: Pros and Cons

OnPay:

Great for: specifically designed for small businesses

If you go to the OnPay website, you’ll notice that this company wants to make payroll as simple and quick as possible. With over 30 years of experience in payroll, OnPay can deliver on that promise. Their software is recognized as some of the easiest to navigate among users, which can be particularly helpful for small business owners. OnPay states that “OnPay is designed to handle payroll for any small business (and their accountants).” The software also allows for integrations with QuickBooks, time tracking software, and more.

Benefits and features:

- 401K Integrations.

- Unlimited monthly pay runs.

- All tax and filing payments.

- W2 and 1099 forms.

- Garnishments.

- Multi-state payroll

- Specialized payroll services based on industry

- Free account migration

Price:

As of 02/18/2022, you will pay a base price every month of $36 + $4 per person/month.

| Number of Workers | Price Per Month |

| 1 | $40 |

| 2 | $44 |

| 3 | $48 |

Patriot:

Great for: Those looking for one of the most affordable options

Patriot another affordable feature-rich option to consider when it comes to the best payroll software for small businesses. In fact, Patriot was ranked as the “best value for the money” on Capterra. Don’t think you are skimping on quality though; Patriot boasts that every tax calculation goes through over 20,000 different tests before hitting your software. Patriot boils down its software into a three-step process.

- Input employee hours (this can be done automatically or manually).

- Review payroll calculation.

- Print paychecks (Patriot does include direct deposits.)

Benefits and features:

- Expert support.

- Unlimited payrolls.

- Employee and administrator portals.

- Free workers compensation integration.

- Mobile friendly

- Electronic and printable W2

- Pay contractors in payroll

- Net to gross payroll tool

Price:

There are two tiers of pricing:

| Plan | Price Per Month |

| Basic Payroll | $10 + $4 per employee |

| Full-Service Payroll | $30 + $4 per employee |

Gusto:

Great for: Those who want an all-in-one platform that can scale.

Ranked as the best payroll software for small businesses by both Business.org and NerdWallet, Gusto brings a lot to the table. Gusto bills itself much like ADP as an all-in-one platform, meaning you can not only complete payroll but HR and other duties as well. Gusto also reports that on average, customers can complete payroll in just 13 minutes using their system. If you are looking for a platform with a lot of flexibility and integrations, Gusto may be your best bet. They’ll even help you with the tax registration process for your employees in all 50 states.

Benefits and features:

- Direct deposit, paper check, and pay card allowed.

- Mobile and desktop applications for employees and administrators.

- Automated taxes for local, state, and federal levels.

- Unlimited payroll.

- Detailed payroll reports and analytics.

- Electronic W-2 and 1099.

- Automatic new hire reporting to U.S government.

- Net to gross calculations.

- Accounting integrations with QuickBooks, Xero, and FreshBooks.

- Automatically sync expenses.

- No payroll setup fees

- Digital signatures

- Calendar Syncing

Price:

| Plan | Price Per Month | Features |

| Core | $39 + $6 per employee | - Full-service payroll including W-2s and 1099 forms - Gusto brokered health insurance administration - Time tracking, accounting, and other integrations |

| Complete | $39 + $12 per employee | - Everything in Core - Next day direct deposit - Time tracking and PTO management - Project tracking and workforce cost reports - Team management tools |

| Concierge | $149 + $12 per employee | - Everything in Complete - HR resource center - Compliance alert - Dedicated support team |

| Select | Custom Quote | - Everything in Concierge - Exclusive deals and customized to your business |

Roll by ADP:

Roll by ADP is different than others on the list. Its concept is simple, but it may not appeal to everyone. This platform was designed to help business owners complete their payroll in minutes. Roll allows users to complete payroll through text messages within their app, which can make it an excellent payroll software for small businesses You just text “run payroll” and employees are paid the next day. This can be a great option for small teams and business owners who are constantly on the goal. It’s a simple application that immediately makes your life easier when it comes to payroll. We highly recommend you check out their Product Overview video to get a visual explainer on how the app works.

Benefits and features:

- Complete payroll in under a minute.

- Tax filing automated.

- Employees can manage pay information right in the application.

- W-2 and 1099 forms.

- Payroll reports

- Payroll alerts

- Garnishments

- Easy to use

- Automatic deductions for benefits and retirement

Price:

Roll by ADP costs a flat rate of $17/month + $5 per employee. Roll does have a 3-month free trial that you can use to see if the software is right for you.

Want to choose the right payroll provider for your small business? 360Connect can help! We help small businesses every day find high-quality suppliers to tackle their business needs. Want to get started? Fill out our form and we’ll contact you to get started.

Prices were recorded at 02/21/2022

Check out our other guides here:

10 Questions to Ask When Choosing a Payroll Service

Gusto vs. Square Payroll