Payroll Services are third party companies that will help a business with their payroll and HR duties through software and automated tools. A payroll servicing company can help a business conduct payroll using:

- In-house Software

- Outsourcing

In-house software payroll services mean that a business owner is still in charge of running payroll, however, they use automated software tools to quicken the payroll process. For example, you could use payroll services to automatically calculate tax withholding. This helps business owners free up time, money, and resources.

Outsourcing payroll services means that an outside company manages all or most of your payroll needs. This can be useful for businesses that are looking to save time and divert resources elsewhere. For instance, an outsourced payroll service would automatically run your payroll and issue direct deposits for employees.

For the purposes of this article, we will be tackling software payroll usage. If you’d like to learn more about outsourcing check out our guide here: In-House vs. Outsourced Payroll: Pros and Cons

Why Do Businesses Use Payroll Services?

Businesses turn to payroll services to optimize time and efficiency. Whether you have 10 employees or 100, payroll services can help you. Importantly, payroll services can help you keep your HR personnel staff to a minimum while providing companies with essential benefits.

Common features completed by payroll services could include:

- Time calculations

- Calculate payroll taxes

- Run payroll

- Pay employees (direct deposit, check, or pay card)

- Pay contractors

- Payroll reports and analytics

- New-hire reporting

- Wage garnishment

- Employee portal for documentation, viewing paystubs, etc.

Benefits of Payroll Services

Not every payroll service is created equally, but there are some common benefits you will find amongst most providers. Most these benefits are applicable to businesses of any size.

Streamline Payroll and Save Time

Once you have logged your employee hourly pay and time into the system, a payroll service will automatically calculate their paycheck for you. This can also include withholdings, retirement benefits, wage garnishments (i.e., child support), and more. More importantly, you can run these calculations in just a couple of minutes.

File Your Taxes Correctly

One of the most difficult parts of calculating payroll is dealing with taxes. Incorrectly filing your taxes can be costly for your business and your employees. Most services will break down your tax duties by local, state, and federal. Furthermore, many services will help you prepare and file your amended tax return which can save you immense time. Some software, such as Paychex, will even help you look for tax credits come tax season.

Employee Direct Deposit

While it is still common to pay people by cash or check, most employers and employees prefer direct deposit. Payroll software can help you set up direct deposits within a day! You’ll just need to input routing and account numbers within the software, and most payroll services can do the rest!

However, many payroll services still offer the ability to pay people through cash, check, or pay card if necessary. Most services can be fine-tuned to your needs.

Have Industry-Specific Features

Not every company will need to calculate tips as part of wages. Not every company will need to use special tax forms for their industry, such as farming. These are payroll problems that are specific to their industry. Fortunately, there are many options on the market that are geared toward different industries.

Less HR Investment

Payroll services allow you to complete the job of many HR employees all within one system. Because most systems automate most parts of the HR process, you can keep your HR costs low. When you do need to scale, employees can become immediately impactful once they learn the automated tools.

Keep Your Employees Happy

If an employee is not paid on time or is not paid properly, they are going to leave your organization. Not only is there are late payroll tax penalties, but can cost you much more from employees leaving your company. According to SD Worx, a global HR firm, a survey found that on average 44% of employees would leave a job if they had been paid incorrectly. Do not let your company fall into this trap.

Cloud Storage

It may seem small like a small factor, but cloud storage is extremely useful. You will be able to store all your HR documents within the cloud. No more endless boxes and filing cabinets. As a result, you and your employees can review, import, and change documents on the fly with a cloud-based payroll system.

3rd Party Integrations

Depending on the payroll services you choose, you’ll have a wide selection of 3rd party apps and services to integrate into your payroll. For example, some businesses would need integration with software like QuickBooks or Indeed. This can empower business owners, HR professionals, and employees to switch between services without wasting time.

Price of Payroll Services

To keep it simple, most payroll services will charge a flat fee + price per employee + cost of addons or services. Flat fees can average around $50-$150, while Investopedia calculates the price per employee around $4-$8. Add-ons or other feature pricing will vary significantly between providers.

You can find out more about payroll pricing in our guide here: How Much Does a Payroll Service Cost?

Top Vendors for Payroll Service

We have written extensively about payroll providers, features, and more. You can find out about top supplier’s pricing, features, use cases, and more here:

What is Paychex Payroll Service?

What is the Kronos Payroll System?

Ready to find the perfect payroll service for you? 360Connect is ready to help you! We help customers find the perfect payroll solution for their business, whether in-house or outsourced. Just fill out our 5-minute survey and we’ll call you to verify some information. After that, you just have to wait for up to 5 suppliers to reach out to you about quotes. That’s it!

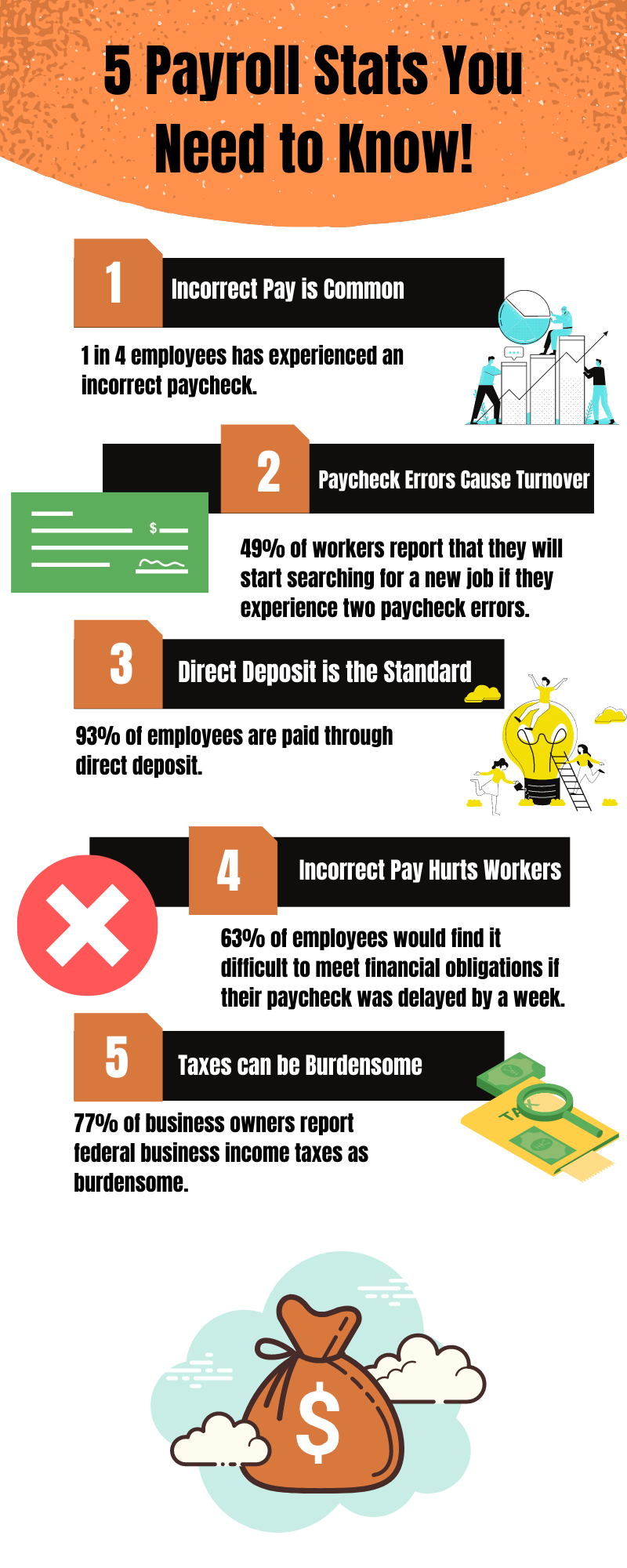

Citations for graphic:

Harris, K. (2020, January 0). 7 things you need to know about the all-american payday. 7 things you need to know about the all-american payday – Article. Retrieved March 15, 2022, from https://quickbooks.intuit.com/r/payroll/7-things-you-need-to-know-about-the-all-american-payday/

Kronos. (n.d.). Getting payroll right may be every company’s … – kronos. Kronos. Retrieved March 15, 2022, from https://www.kronos.com/resource/download/20956

Nacha. (2020, April 6). How direct deposit works. Nacha. Retrieved March 15, 2022, from https://www.nacha.org/content/how-direct-deposit-works

American Payroll Association. (2021). “Getting paid in america” survey results. National Payroll Week. Retrieved March 15, 2022, from https://dev.nationalpayrollweek.com/wp-content/uploads/2019GettingPaidInAmericaSurveyResults.pdf

NFIB Research Center. (2021). NFIB tax 2021 survey. NFIB. Retrieved March 15, 2022, from https://assets.nfib.com/nfibcom/NFIB-Tax-Survey-Full-Report.pdf