Small businesses can often struggle with payroll duties. For instance, a plumber who starts a small business will most likely know all the steps to fix a complex sewage problem. However, do they have the same in-depth knowledge of calculating payroll taxes? What about withholdings? That’s where online payroll tools can help small businesses. These tools can help with the finer details of payroll and empower small teams to increase their workload and automate the process. In turn, businesses can scale and be compliant with the law. Here’s a full breakdown of how online payroll can help small businesses like yours and what you can expect.

What is Online Payroll?

Benefits of Using Online Payroll for Small Businesses

While every online payroll service has its unique features or support that can make them the right choice for your business, there are some general benefits that most companies can expect from online payroll for small businesses.

Time and cost savings

Online payroll for small businesses is going to save your business a lot of money and time. Firstly, most of the processes from payroll can be automated. Times can be recorded, viewed, or altered all through one dashboard. Second, the software can compile this data for you and spot potential errors in data or miscalculations. Thirdly, you can service a wide range of employees with the software and a much smaller team of HR professionals. Some business owners who do payroll themselves are able to complete the entire process in under 20 minutes.

Compliance with tax and labor laws

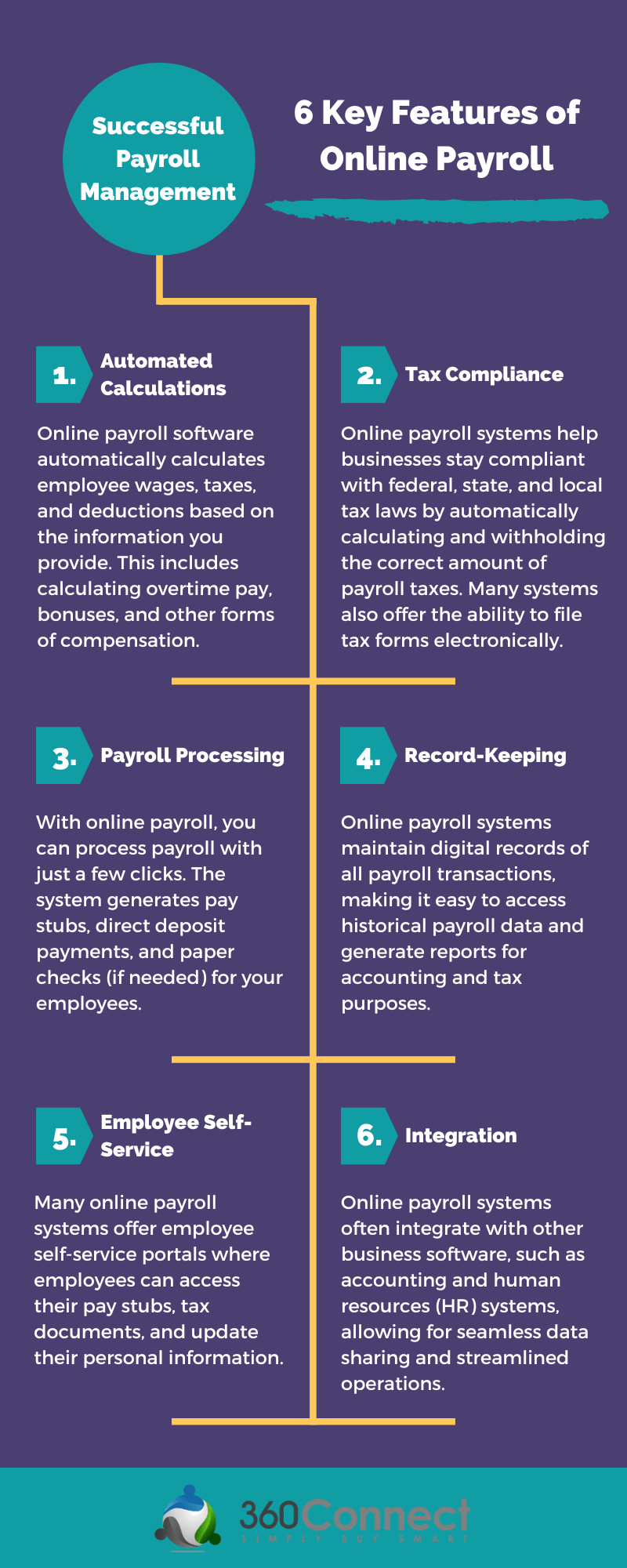

Most online payroll software will automatically deduct taxes and other deductions from employee payments. Most software can also help you with generating tax forms when it comes to tax season.

Employee self-management

When employees don’t feel in control of their financial situation, that’s when they start having problems. Most online payroll suppliers offer an employee portal to manage things like PTO, pay information, holidays, deductions, tax information, and personal information. Not only does the help employees keep track of time and benefits, but it also facilitates better communication between employees and management. No more making mental notes of when employees are taking off. It can already be integrated with your calendar and payroll duties.

Scalability and Flexibility

One of the best benefits of online payroll for small businesses is flexibility and scalability. Most programs allow you to add new employees in minutes. Employees can also fill out paperwork on their phone or computer, eliminating tasking your HR staff with that duty as well. Most programs also provide ease of access when it comes to both HR departments and employees. You can create custom workflows and automation within the system.

You can also work remotely as any information can be accessed with the correct login information.

Always Upgrading

Because these systems are online, that means that they can receive updates via the Internet. You can receive new features overnight and put them to use the very next day. You are not limited in your ability to have the latest features even if you are locked into a contract. Although many online payroll systems offer month-to-month payments where you can cancel at any time.

How to Choose an Online Payroll Provider

While online payroll for small businesses is a fantastic idea, that doesn't mean every provider is the same. Some offer more features, while others charge special fees for specific features.

Pricing and fees

Like most things when it comes to business, it's all about the price. Before shopping around, determine what you are willing to pay per month or yearly. Also, determine which features you absolutely need. If you'd like to know about some top providers and pricing, check out our article here:

The 6 Best Payroll Software for Small Businesses

Learn MoreFeatures and functionality

Features are obviously very important when it comes to choosing a system. However, just as important is the ease of use of a system. You don't want to sign up for software that takes several weeks to learn. This is especially true if you are a small business owner with limited staff. Ask the supplier to see a free demo of the product before choosing. You want to be up and running as soon as possible to put the software to good use.

Customer support and user reviews

Lastly, does your supplier have a good reputation in the industry? Always check reviews of suppliers before signing on with them. While a sales rep may talk a good game, you may find that customers are unsatisfied. Make sure to also talk about the type of customer support the company offers. Ask questions like:

- What kind of customer support does the payroll provider offer?

- Is customer support available through phone, email, or live chat?

- What are the hours of availability for customer support, and what is the typical response time?

- Does the payroll provider have a good reputation and track record?

- What do other small businesses say about their experiences with the payroll provider (e.g., online reviews, testimonials)?

- How long has the provider been in business, and do they have experience serving businesses similar to yours?

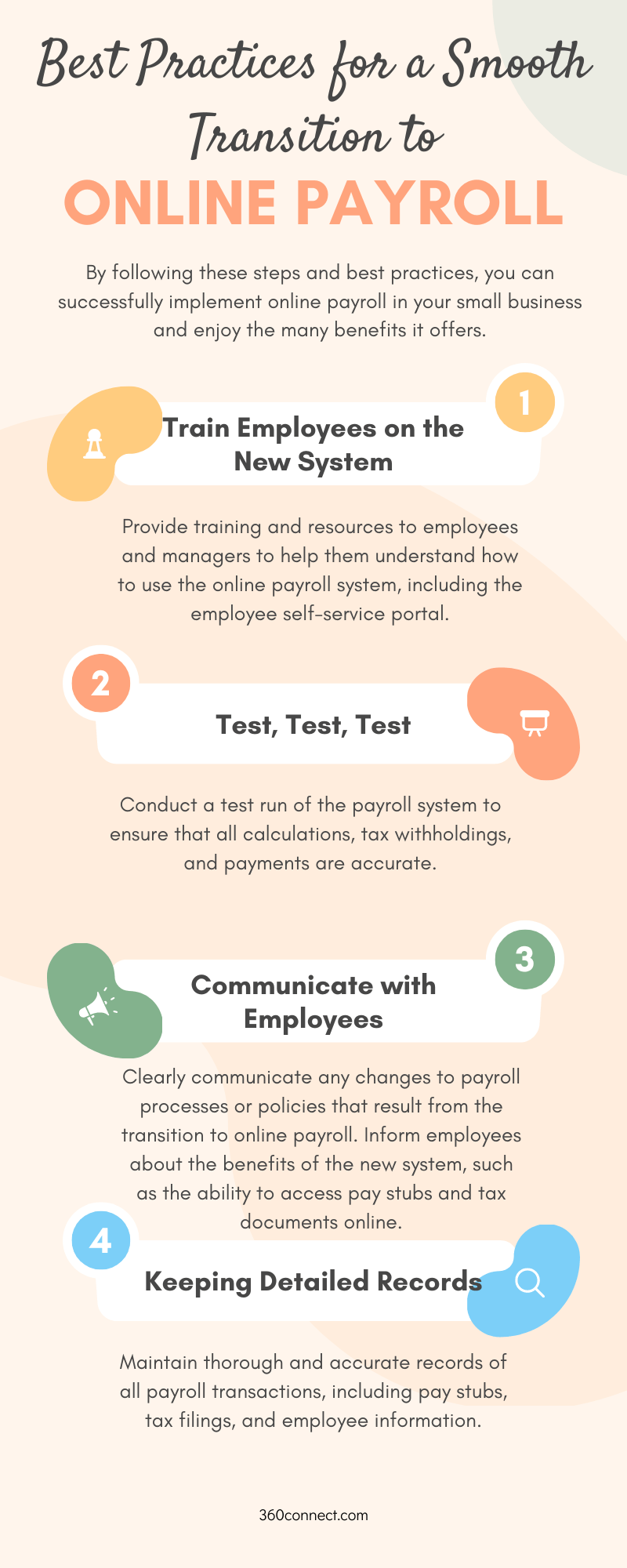

Implementing Online Payroll in Your Small Business

Transitioning to an online payroll system can significantly improve the efficiency and accuracy of your payroll operations. You don't need to be a genius to add better payroll services to your businesses, but you do need to have some guidelines. Here they are simplified into 3 simple steps.

Registering with the Payroll Provider

Choose an online payroll provider that meets your business's needs and requirements. After you have chosen a provider, create an account and register your business.

Entering Employee Information and Payroll Details

Input employee information into the online payroll system, including names, Social Security numbers, addresses, and bank account details (for direct deposit). Any other information relevant to payroll should be entered, including employee compensation rates (hourly or salaried), work hours, overtime rates, bonuses, etc.

Configuring Payroll Settings and Preferences

Set up payroll preferences, such as pay frequency (e.g., weekly, biweekly, monthly), pay dates, and payment methods (direct deposit, paper checks, debit card, etc.). Configure tax settings, including federal, state, and local tax withholdings, as well as any employee-specific deductions or contributions (e.g., retirement plans, health insurance).

Ready for Online Payroll for Your Small Business?

Need an online payroll system that works for your needs? Good! 360Connect can help your business find the solution it needs. Just fill out our 1–2-minute form and we'll contact you to verify your information and needs. From there, you can relax and receive up to 5 different quotes from different suppliers. It's that easy!