Listen, no small business owner wakes up and thinks “My god, I’m so happy to run payroll.” But that’s usually because they don’t have the right payroll software to empower them. In fact, around 25% of small businesses are still using pen and paper to conduct their payroll for their business. However, that doesn’t have to be you. With the right software solution, payroll could turn into one of the most simple and basic tasks you have to face in a day. No longer a burden, but a strength. You’re going to the right features though to make this happen. Not to mention, not every payroll software offers the same benefits. Let’s break down the must-have payroll software features to take your business to the next level.

Payroll Software Explained: What You Need to Know

Must-Have Features:

These are some of the most valuable features you can have when choosing payroll software. If you’d like to check out some of the top choices, check out our article here:

The 6 Best Payroll Software for Small Businesses

Learn MoreTime-Tracking and Management

Time tracking for business is insanely important for most businesses. Companies need to monitor when and where employees are working to calculate accurate payroll (most applicable to hourly employees). Some payroll software solutions will include the time-tracking feature, others will allow you to integrate time-tracking tools into the software. It’s important to have this feature when it comes to:

- Holiday pay

- Overtime pay

- Bonuses

- Emergency pay

It will simplify your payroll and help the software calculate your payroll totals.

Multiple Payment Methods (direct deposit, check, pay card, etc.)

Around 93% of employees are paid through direct deposit according to one study. Direct deposit is convenient and safe for both employers and employees. Because this has become a standard across industries, you need a payroll system that can at least accommodate direct deposit.

However, it can also be beneficial to choose payroll software that handles multiple forms of payment. Some employees may prefer a different method. Also, other payment methods may be better for contract labor. Not to mention, you’ll also want the option to run payroll at different times like monthly or bi-monthly.

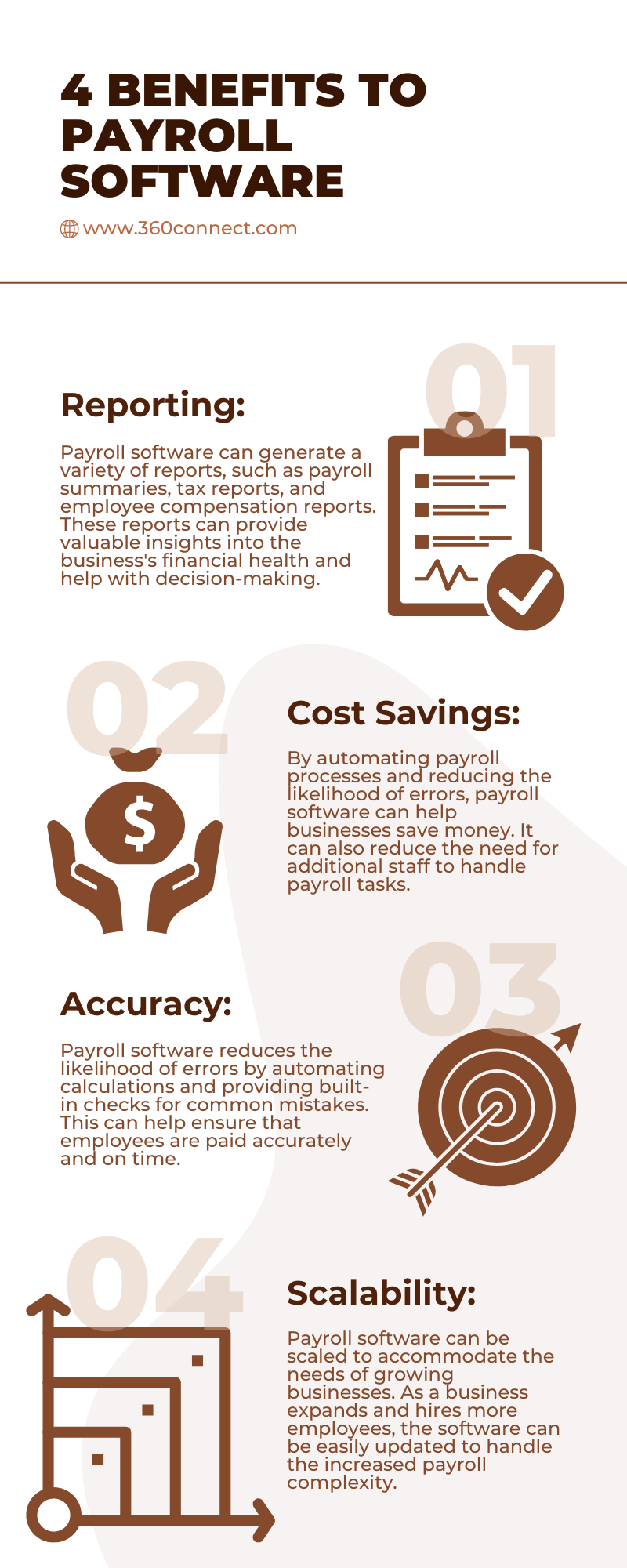

Expense & Analytic Reporting

When it comes to payroll, you need both the bigger picture and the finer details. The right payroll software should help you with seeing those larger details. You should have access to reporting tools such as:

- General payroll expenses

- Compensation across sectors

- HR and employee reports

- New hires

- Attendance reports

- Overtime shifts

- Turnover rates

- And many more!

Tools like these can help you get a better financial look at your business and make decisions on accurate data. Not having expert data tools is one of the worst mistakes you can make with payroll.

Track Multiple Compensation Packages

One of the most important duties of HR is to track compensation across sectors and employees in your company. Having a budget for compensation and going after competitive candidates is going to keep your business firing on all engines. Having these features also makes it easier to plan for raises, bonuses, and retain employees.

Employee Portal

Having a stellar payroll option doesn’t just mean that your HR team benefits, it also means that your employees have access to features as well! An employee portal makes it easy for them to submit time off, send messages to managers, and review benefits or company documents. Employee self-service portal frees up time for both HR professionals and employees while eliminating excessive work.

Automated Processing

Obviously, automating your payroll is going to be a huge improvement for small businesses. With time integrations, you can run payroll with just a couple of clicks. Payroll software allows employers to automate recurring payroll tasks, such as running payroll on a specific schedule (e.g., weekly, bi-weekly, monthly), sending out pay stubs, and filing tax reports. Most software will maintain a comprehensive record of all payroll transactions, including payments, deductions, and tax filings.

Tax Compliance Tools

By automatically computing and deducting the proper amount of taxes from each employee's paycheck, payroll software assists businesses in adhering to tax requirements. The software can also help generate tax forms and reports, making it easier to file taxes with the relevant authorities. Tax compliance tools are one of the most valuable payroll software features.

Integration Tools

This feature can make or break your experience with payroll software. Having the right integrations with your payroll service can empower your workforce and streamline activities into one software. Your data retention skills improve when you are able to integrate multiple systems. This integration streamlines processes by automating data transfer between systems, reducing manual data entry, and minimizing errors.

Not only that, but workers are more satisfied when they can keep all their operations located in one application. You simplify the workflow for HR staff and employees.

Encryption and Data Security

Looking for a more robust way of storing sensitive documents? Most payroll services use encryption and role-based access to safeguard documents and employee information. While you can never totally eliminate the possibility of a cyber-attack, it's good to know that payroll software features like two-factor authentication can keep your data safe.

Robust Customer Support or FAQ Guide

Lastly, a payroll software feature that can make all the difference is customer support tools. These can chat-like features, a FAQ, or even a direct line to customer support. Why is this so important? When dealing with payroll, you never want to be on your own. Talk with a supplier before about the support they offer in case something goes wrong.

Choosing the Right Payroll Software

Choosing the right payroll for a company may seem hard, but it doesn't have to be. Look for the features listed above and keep a couple of key things in mind when searching such as:

- Identify the specific payroll needs of the business, such as processing frequency, employee types, and tax requirements.

- Consider the level of automation and customization offered by the software.

- Evaluate the software's security measures to ensure the protection of sensitive employee data.

- Compare pricing and fee structures to ensure the software fits within the business's budget.

- Read customer reviews and ratings to gauge user satisfaction and the reliability of the software.

- Try to choose providers that will allow you to demo the software or offer a free trial.

- Consider options that will make it easy to scale as your workforce scales.

- Determine whether the software is easy to use and how much training will be necessary for HR staff and employees.

Again, before choosing a provider, try to receive multiple offers and test different suppliers. This will give you a firm idea of what works for your company and what does not.

Need Payroll Software that Understands Your Needs?

360Connect can help you! Just fill out our 1–2-minute form and we'll call you to verify your information and needs. From there, you'll receive up to 5 quotes from software providers who will tell you about their features and products. It's that easy! Get started today!